From Company's Prospectus

1. Business

Description

Engaged in providing

pawnbroking services and retail and trading of pre-owned jewellery and watches.

Incorporated in

2008, Money Max is engaged in providing pawnbroking services and retail and

trading of pre-owned jewellery and watches. It has since established a total of

27 outlets across Singapore

under 2 brands, (1) Money Max - 26 Outlets & (2) Cash Online - 1 Outlet, enabling the company to

offer its customers convenient access to its service.

From Company's Prospectus

Pawnbroking Services

Collateralize lending. Pawnbroking services generally relate to the provision

of non-recourse, short term loans secured by pledged articles. Its customers

are typically individuals who require short term funds and are able to pledge

valuable articles, such as jewellery and branded watches as collateral.

Retail and trading

pre-owned jewellery & watches

Trading business for

jewellery & watches. Max Money retails and trades pre-owned jewellery and watches which they

purchase from (i) walk-in customers; (ii) independent dealers and/or traders of

2nd hand goods; (iii) from their pawnshops' unredeemed pledges which are not

bid for at the licensed public auctions; and (iv) pawnshops' unredeemed pledges

which they successfully bid for at the licensed public auctions

From Company's Prospectus

Despite

contributing 23.2% of FY12 revenue, pawnbroking accounts for 80.8% of Profit

before tax. If

you look closely into the numbers, you will notice that despite contributing

23.3% of FY12 revenue, pawnbroking actually accounts for 80.8% of Profit before

tax!

This is not surprising. Pawnbroking is a form

of collateralize lending. As long as the customer doesn't redeem the pledged

items but continue to service its interest, it can be a good source of

recurrent income. Even in the event that the customer stops paying, Money Max

is well protected due to the collateral it takes.

Do

note that the amount of interest that Money Max can charge is regulated under

the Pawnbrokers Act whereby they are allowed to charge interest at a rate of up

to 1.5% per month on the amount of the loan.

You will also notice (from the table below)

that the trading business for jewellery & watches is a low margin business.

This is a common trait for any physical trading as the goods they trade are

pretty commoditized and one can only compete from a pricing perspective.

Note: For a more detailed explanation of how the 2

businesses work, one can refer to page 68-71 of the Prospectus.

2. Use of Proceeds

From Company's Prospectus

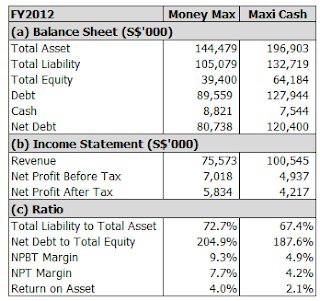

3. Financial Highlights

In

the world of finance, everything is relative.

I

have provided below some comparison between Money Max and its closer

competitor, Maxi Cash.

Round 1: Size (Winner: Maxi

Cash)

Maxi Cash currently has 2 more branches than

Money Max, providing them with more distribution network. Maxi Cash also has a

bigger balance sheet compared to Money Max and thus has a size advantage

compared to Money Max.

Round 2: Financial Numbers (Winner: Money Max)

Despite having a smaller balance sheet and

generating a smaller revenue base, Money Max actually achieved a higher Net Profit

Before & After Tax compared to Maxi Cash. As a result, Money Max were able

to achieve a better margin and Return on Asset. Thus, it seems to me that Money

Max has a higher operating efficiency compared to Maxi Cash.

Round 3: Valuation (Winner –

Money Max)

In

terms of valuation, it seems that Money Max is priced more attractively compared

to Maxi Cash both on a (1) Premium over NAV and (2) PE perspective.

4.

Investment Highlights

Well-established

market player. With

27 outlets strategically located across Singapore, Money Max is a well-established

market player.

Low

interest rate environment. Depending on your interest rate view, this can act as a

double-edged sword. If the interest rate environment continues to stay low, the

pawnbroking business will be a sweet spot, as Money Max can borrow low &

lend higher. This will result to a very decent margin for them.

Money Max

looks cheap compared to Maxi Cash. As highlighted above, Money Max looks cheap

compared to Maxi Cash and on a relative value perspective, it seems like a

safer bet to buy Money Max compared to Maxi Cash.

5.

Investment Risk

Raising

interest rate environment. Note that the amount of interest Money Max can charged

is been artificially capped by the Pawnbroker Act. In the event their borrowing

cost becomes higher, their margin will be squeezed.

Declining

margin on its trading business. Like I mentioned above, physical trading

business is a tough market as the product they trade are pretty commoditized.

If you noticed its NPBT margin for its trading business, it seems to be on a

declining trend, signalling how tough the business actually is.

Volatile

gold price. If

you have been following gold price, you should know how volatile the market has become.

Being a gold trader and taking gold as pledged asset, Money Max might be

exposed to the volatile price action and might get caught on the wrong side

anytime.

6.

Technical Analysis

Technical

bid should be strong for this

given the subscription history of Maxi Cash and its initial price performance.

7. Conclusion

I

have a feeling that this is another “All In” IPO given the cheap valuation and

strong technical bid for it.

I

will definitely put money to work here.

8. Timetable

From Company's Prospectus